Imagine the Indian economy as a massive, bustling reservoir. The water in this reservoir is Money. If there is too much water, it floods (Inflation). If there is too little, the fields dry up (Recession/Slowdown). Standing at the floodgates, controlling the flow with precision, is the Grand Guardian: The Reserve Bank of India (RBI).

These notes will take you through the machinery the RBI uses to keep this reservoir stable, a topic essential for the RBI Monetary Policy UPSC syllabus.

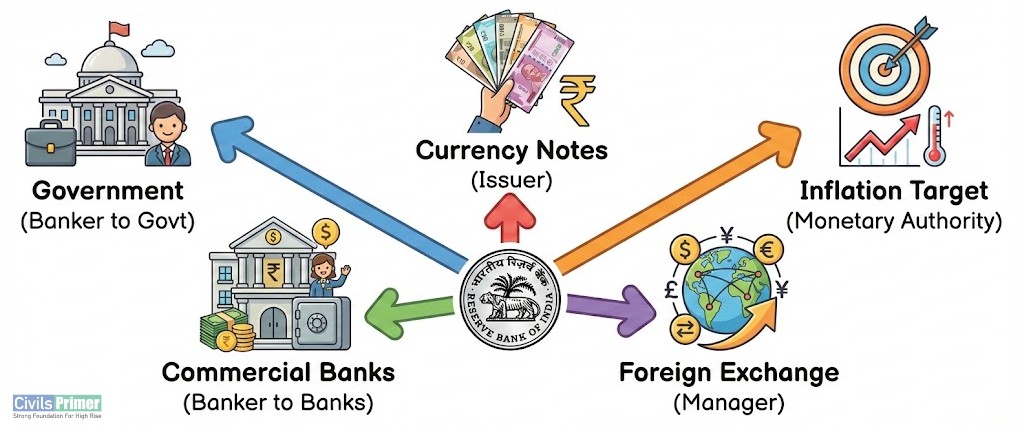

Functions of Reserve Bank of India (RBI) #

The Reserve Bank of India isn’t just a bank; it is the “Banker to the Banks” and the “Banker to the Government.” Established under the RBI Act, 1934, it has the sole right to issue currency notes (except one-rupee notes and coins, which are issued by the Government).

The Core Duties of RBI:

- Issuer of Currency: The RBI ensures there is enough cash in circulation.

- Banker to Government: It manages the accounts of the Central and State governments (except Sikkim), manages public debt, and provides ways and means advances (temporary loans) to them.

- Banker to Banks: It holds the accounts of commercial banks, enabling interbank transfers and ensuring they maintain statutory reserves.

- Lender of Last Resort: When a solvent bank faces a temporary liquidity crisis and has nowhere else to turn, the RBI steps in to protect depositors’ interests and prevent bank failure.

- Manager of Forex: It stabilises the Rupee by buying and selling foreign currency in the market to reduce volatility.

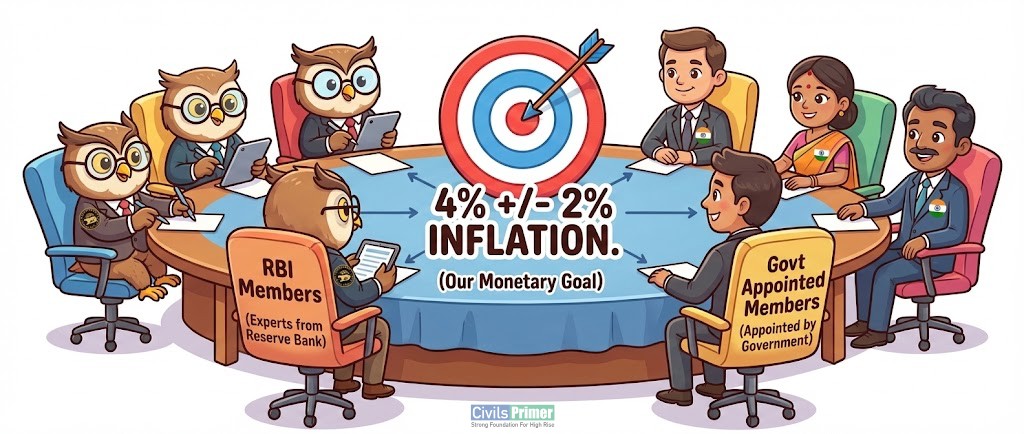

Monetary Policy Framework (MPC): The War Room #

To manage the flow of money, the RBI cannot act on a whim. It follows a Monetary Policy Framework. The primary objective is to maintain price stability (control inflation) while keeping growth in mind.

The Inflation Target: The Central Government, in consultation with the RBI, sets a flexible inflation target. Currently, this target is 4% with a tolerance band of +/- 2% (i.e., 2% to 6%). The inflation measured is the Consumer Price Index (CPI) – Combined.

The Decision Makers: The Monetary Policy Committee (MPC) Decisions on interest rates are not made by the Governor alone but by the Monetary Policy Committee.

- Composition: It is a 6-member body. Three members are from the RBI (including the Governor) and three are appointed by the Central Government.

- Voting: Decisions are made by majority vote. In case of a tie, the RBI Governor has a casting vote.

- Mandate: The MPC determines the Policy Repo Rate required to achieve the inflation target.

Policy Rates: The Levers of Control #

To influence the Indian Banking System UPSC aspirants must understand the specific tools (levers) the RBI pulls to release or absorb money.

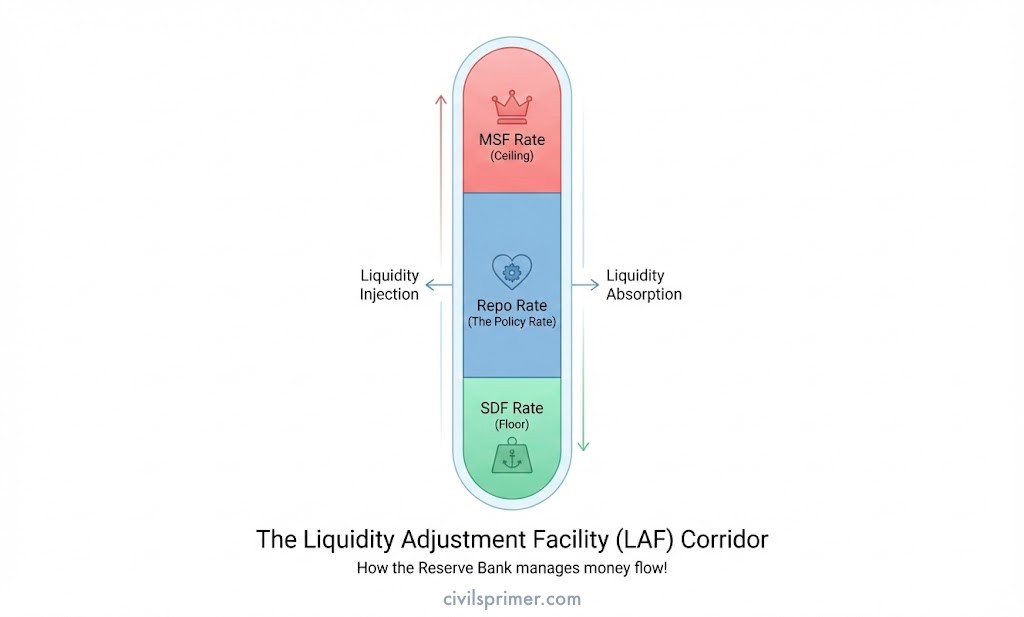

A. Repo Rate (The Anchor) This is the interest rate at which the RBI lends money to commercial banks for the short term against government securities.

- Scenario: If inflation is high, the RBI increases the Repo Rate. Loans become expensive for banks, who then charge higher rates to customers. People borrow less, spending drops, and inflation cools down.

- Current Context: The Repo Rate stands at 6.50% (as per recent trends).

B. Standing Deposit Facility (SDF) Rate Think of this as the “floor” or the bottom limit. It is the rate at which the RBI accepts uncollateralized deposits from banks on an overnight basis. It replaced the fixed Reverse Repo rate as the floor of the LAF corridor.

C. Marginal Standing Facility (MSF) This is the “emergency window.” If banks run out of money and need to borrow overnight, they can use this facility. It allows banks to dip into their Statutory Liquidity Ratio (SLR) portfolio up to a specific limit (2%) to borrow cash. The interest rate is higher than the Repo Rate (penal rate).

D. Bank Rate This is the rate at which the RBI re-discounts bills of exchange. It acts as a penal rate charged on banks if they fail to meet their reserve requirements (CRR/SLR).

Liquidity Adjustment Facility (LAF): The Daily Balance #

The LAF is the mechanism used by the RBI to inject or absorb liquidity into the banking system daily.

- Injecting Liquidity: If banks need cash, the RBI uses Repo auctions to lend to them.

- Absorbing Liquidity: If there is too much cash (surplus liquidity) floating around, the RBI uses the Standing Deposit Facility (SDF) or Reverse Repo to take that money out of the system.

Open Market Operations (OMO): Beyond daily adjustments, if the RBI wants to control liquidity for a longer duration, it uses OMOs. This involves the outright buying or selling of Government Securities (G-Secs) in the market.

- Buying G-Secs: RBI pays cash to banks ? Liquidity Increases.

- Selling G-Secs: Banks pay cash to RBI ? Liquidity Decreases.

Reserve Ratios (CRR and SLR): The Reservoirs #

Before banks can lend money to you or me, they must set aside a portion of their deposits. This ensures safety.

1. Cash Reserve Ratio (CRR):

- What is it? A percentage of a bank’s total deposits (Net Demand and Time Liabilities – NDTL) that must be kept as cash with the RBI.

- Interest: Banks earn no interest on CRR.

- Purpose: It ensures solvency and controls liquidity. A higher CRR leaves banks with less money to lend.

2. Statutory Liquidity Ratio (SLR):

- What is it? A percentage of deposits banks must keep with themselves in the form of liquid assets like cash, gold, or government securities.

- Purpose: It ensures that banks always have liquid assets to meet sudden withdrawal demands from depositors.

Structure of Indian Banking: The Army of Banks #

The Indian Banking System UPSC syllabus categorizes banks into specific types based on their function and structure.

A. Scheduled Commercial Banks (SCBs) These are banks listed in the Second Schedule of the RBI Act, 1934. They include:

- Public Sector Banks (PSBs): Majority stake held by the government (e.g., SBI).

- Private Sector Banks: Majority stake held by private individuals (e.g., HDFC, ICICI).

- Foreign Banks: Headquartered outside India but operating here.

B. Cooperative Banks These operate on the principle of “no profit, no loss” and mutual help. They are under dual regulation:

- Managerial/Administrative control: State/Central Registrar of Cooperative Societies.

- Banking functions: Regulated by RBI under the Banking Regulation Act, 1949.

C. Regional Rural Banks (RRBs) Created to serve rural areas. They are regulated by the RBI but supervised by NABARD. Their ownership is shared: Central Govt (50%), State Govt (15%), and Sponsor Bank (35%).

D. Small Finance Banks (SFBs) They are niche banks established to further financial inclusion for small business units, small and marginal farmers, and unorganised sector entities. They are required to extend 75% of their loans to priority sectors.

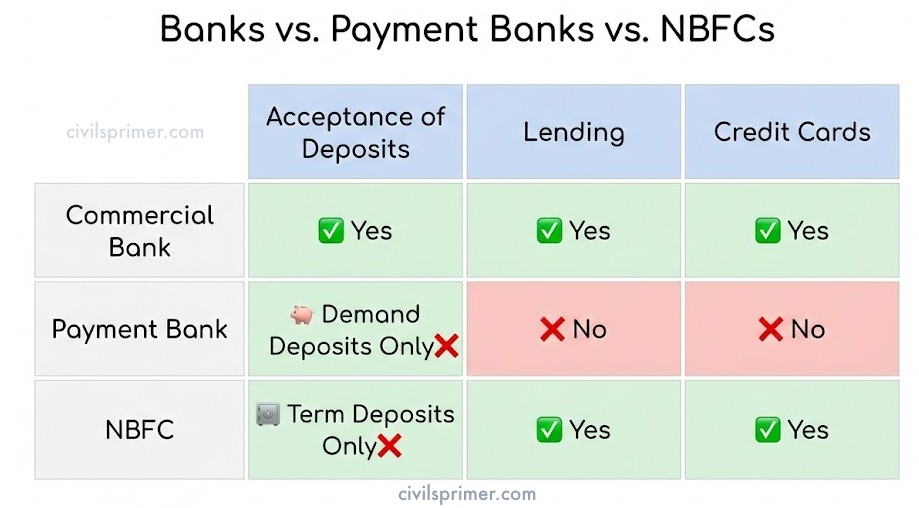

Payment Banks & NBFCs: The Digital Revolution #

Payment Banks These are a special type of “differentiated bank” introduced to promote financial inclusion.

- Can: Accept demand deposits (up to ?2 lakh), issue ATM/debit cards, provide remittance services.

- Cannot: Lend money (no loans), issue credit cards.

- Example: India Post Payment Bank (a public sector company).

Non-Banking Financial Companies (NBFCs) These are the “Shadow Banks.” They provide financial services but do not hold a banking license.

- Key Difference: Unlike banks, NBFCs cannot accept demand deposits (chequeable deposits). They also do not form part of the payment and settlement system.

- Role: They are crucial for last-mile lending, infrastructure financing, and microfinance.

- Regulation: Recently, the RBI introduced a “Scale-based Regulation” (Base, Middle, Upper, Top layers) to manage NBFCs better.

Financial Inclusion & The Digital Leap #

Financial inclusion means providing affordable financial services to the unserved.

- Priority Sector Lending (PSL): The RBI mandates banks to lend a certain portion (usually 40% for commercial banks, 75% for SFBs/RRBs) to specific sectors like agriculture, MSMEs, and education. Recently, Startups were also added to PSL.

- NPCI: The National Payments Corporation of India acts as the umbrella organization for retail payments. It developed UPI (Unified Payments Interface), RuPay, and BHIM.

- Central Bank Digital Currency (CBDC): The RBI has launched the e-Rupee. It is a legal tender in digital form, fungible with fiat currency, but distinct from cryptocurrencies.

Basel Norms: The Shields #

To ensure banks don’t collapse during financial stress, they follow international standards called Basel Norms.

- Focus: Capital Adequacy Ratio (CAR). This is the ratio of a bank’s capital to its risk-weighted assets.

- Basel III: These are the current norms, aiming to improve the banking sector’s ability to absorb shocks arising from financial and economic stress. It mandates banks to maintain specific capital buffers.

Summary for UPSC Prelims #

- RBI controls inflation using the Repo Rate via the MPC.

- MPC targets 4% (+/- 2%) CPI inflation.

- LAF manages daily liquidity; MSF is for emergencies.

- Payment Banks cannot lend; NBFCs cannot accept demand deposits.

- RRBs are supervised by NABARD.

- NPCI manages UPI and RuPay.

Mastering these concepts of the RBI Monetary Policy UPSC and Indian Banking System UPSC syllabus will provide a solid foundation for your economic preparation.

UPSC Mains PYQs: Indian Banking System, Monetary Policy #

Indian Banking System, Monetary Policy, UPSC Mains PYQs

- 2019: Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments.

- 2017: Among several factors for India’s potential growth, the savings rate is the most effective one. Do you agree? What are the other factors available for growth potential?

- 2016: Pradhan Mantri Jan-Dhan Yojana (PMJDY) is necessary for bringing unbanked to the institutional finance fold. Do you agree with this for financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion.

Latest UPSC Current Affairs: Indian Banking System, Monetary Policy #

Monetary Policy and Banking System Current Affairs

| (November, 2025) The Banking Laws (Amendment) Act, 2025 This comprehensive reform amends five key legislations to modernize governance, raising the ‘substantial interest’ threshold to ₹2 crore and reforming cooperative bank director tenures. It also empowers Public Sector Banks to transfer unclaimed assets to the Investor Education and Protection Fund (IEPF) and enhances statutory audit independence. |

| (November, 2025) RBI Conducts Variable Rate Reverse Repo (VRRR) Auction As part of its Liquidity Adjustment Facility (LAF), the RBI conducted a ₹1 lakh crore 7-day VRRR auction to absorb surplus liquidity from the banking system. This tool allows banks to lend funds to the RBI at market-determined rates, influencing short-term money market rates like the call money rate. |

| (November, 2025) Ban on Pre-Payment Charges for Floating Rate Loans The RBI has barred lenders from levying pre-payment penalties on floating-rate loans for individuals and Micro and Small Enterprises (MSEs) effective January 2026. This regulatory shift aims to enhance loan portability, promote competition among lenders, and ensure fair lending practices. |

| (October, 2025) Constitution of Payments Regulatory Board (PRB) The RBI replaced the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) with a six-member PRB to regulate all domestic and cross-border payment systems. Chaired by the RBI Governor, the new board includes government nominees to ensure oversight and modernization of payment infrastructures. |

| (October, 2025) Review of Flexible Inflation Targeting (FIT) Framework With the current 4% CPI target expiring in March 2026, the RBI released a discussion paper seeking stakeholder views on retaining the Headline Inflation target. Most respondents supported continuing the existing 4% target with a +/- 2% tolerance band to anchor inflation expectations and maintain credibility. |

| (October, 2025) Banking Regulation Amendments and Basel III Norms The RBI increased the eligible limit for Perpetual Debt Instruments (PDI) issued abroad, allowing banks to raise Tier-1 capital up to 1.5% of risk-weighted assets to boost capital adequacy. Additionally, banks were permitted to reduce the spread on floating-rate loans before the lock-in period ends to ensure faster policy rate transmission. |

| (October, 2025) Self-Regulatory Organisation (SRO) Status for NBFCs The RBI granted SRO status to the Finance Industry Development Council (FIDC) to enforce industry standards and dispute resolution within the NBFC sector. This recognition is intended to enhance industry discipline, peer monitoring, and build market confidence in Asset and Loan Financing NBFCs. |

| (September, 2025) Financial Inclusion Index (FI Index) Improvement The RBI’s FI Index improved to 67 in March 2025 from 64.2 the previous year, driven by improvements in usage and quality parameters. This comprehensive index captures data across banking, investments, insurance, and postal services to measure the extent of financial inclusion ranging from 0 to 100. |

| (August, 2025) Nomination to Monetary Policy Committee (MPC) The RBI nominated Executive Director Indranil Bhattacharyya as an ex-officio member of the MPC, which is responsible for fixing the benchmark repo rate. The MPC is a statutory body under the RBI Act, 1934, designed to maintain price stability while keeping growth objectives in mind. |

| (July, 2025) Reduction in Priority Sector Lending (PSL) Targets for SFBs The RBI reduced the overall PSL target for Small Finance Banks (SFBs) from 75% to 60% to enhance their operational flexibility and profitability. While the additional PSL component dropped to 20%, SFBs must still allocate 40% of their Adjusted Net Bank Credit to specific PSL sub-sectors. |