A Guide to Inflation in India: UPSC Exam (Prelims and Mains) #

Imagine you are walking through a bustling Indian market in 2010 with ₹100 in your pocket. You buy a kilogram of apples and still have change left for a rickshaw ride home. Now, imagine visiting the same market today with the same ₹100 note. You might not even get half a kilogram of apples. The apples haven’t changed, but the power of your ₹100 note has weakened. This invisible force shrinking the value of your money is what economists call Inflation.

For a civil servant, understanding this force is vital because it determines the welfare of the people. Let’s unravel this economic mystery.

Meaning and Types of Inflation: The Invisible Thief #

Inflation is not just a one-time price rise; it is a persistent increase in the general price level of goods and services in an economy over a period of time. When this happens, each unit of currency buys fewer goods. Essentially, inflation reflects a reduction in the purchasing power of money.

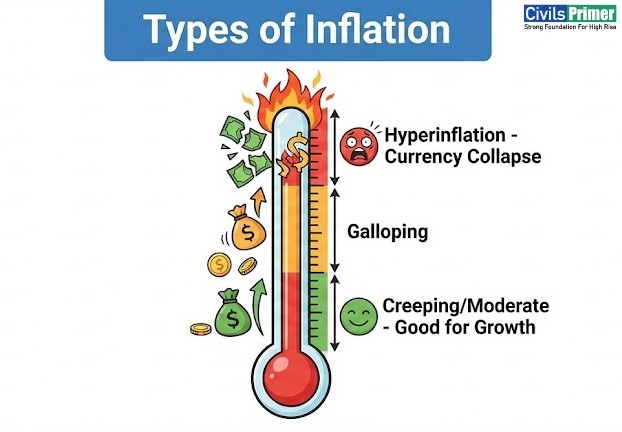

However, not all price rises are the same. Economists categorize them based on speed and cause:

- Creeping to Hyperinflation: If prices rise very slowly, it is good for the economy as it encourages production. But if they rise extremely fast, causing the currency to lose value daily, it is called Hyperinflation.

- Headline vs. Core Inflation: When you read the newspaper, you see two types. Headline Inflation is the total inflation number, including volatile items like food and fuel. Core Inflation removes these volatile items (food and energy) to show the long-term trend of the economy.

Demand-Pull and Cost-Push Inflation: The Tug of War #

Why do prices rise? Imagine a tug-of-war between the buyers (Demand) and the sellers (Supply).

- Demand-Pull Inflation (Too Much Money Chasing Too Few Goods)

This happens when the total demand for goods and services (Aggregate Demand) increases faster than the economy’s ability to produce them (Aggregate Supply).- The Story: If the government gives everyone a bonus (increasing money supply) or cuts taxes, people have more money. They rush to buy cars and houses. If factories cannot build cars fast enough, they raise prices.

- Triggers: Increase in government expenditure, lower interest rates (cheap loans), or an increase in exports.

- Cost-Push Inflation (The Supply Shock)

This occurs when the cost of producing goods goes up, forcing companies to raise prices to maintain profits.- The Story: If global crude oil prices shoot up, the cost of transporting vegetables increases. The vegetable seller has to charge you more not because you are rich, but because his costs have risen.

- Triggers: Hoarding of commodities, supply chain disruptions (like during Covid-19), or a rise in raw material costs.

There is also a new villain in town called Greedflation. This happens when corporations increase prices not just to cover costs, but to increase their profit margins, exploiting a crisis situation.

CPI vs WPI Explained: The Tale of Two Baskets #

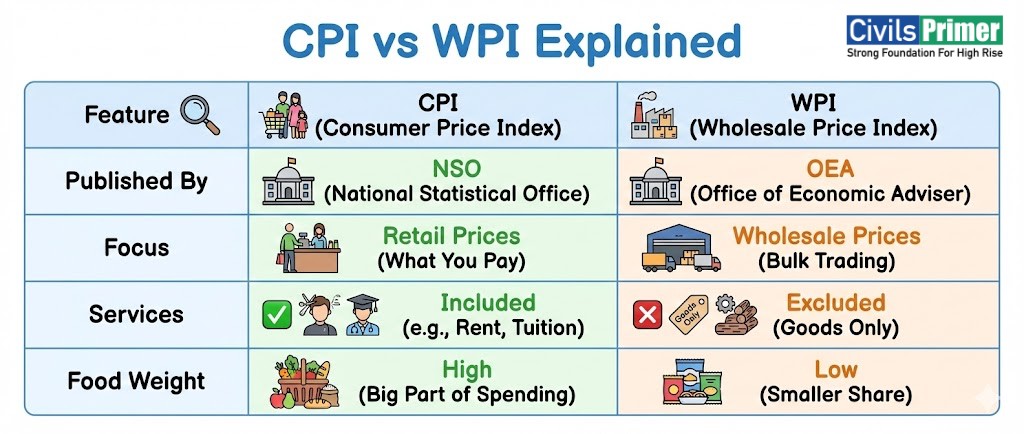

To manage inflation, the government must measure it. In India, we use two main measuring tapes: the Wholesale Price Index (WPI) and the Consumer Price Index (CPI).

Wholesale Price Index (WPI) – The Producer’s View

- The Concept: This measures inflation at the first stage of the transaction—between businesses (wholesale market). It tracks prices of goods before they reach you, the consumer.

- The Basket: It is dominated by manufactured products (64.23% weight), followed by primary articles (22.62%) and fuel (13.15%).

- The Catch: WPI does not capture the price of services (like education or healthcare).

- Authority: Released by the Office of the Economic Adviser, Ministry of Commerce and Industry.

Consumer Price Index (CPI) – The Common Man’s View

- The Concept: This measures changes in the price level of a basket of consumer goods and services bought by households. This is what impacts your wallet directly.

- The Basket: It includes both goods and services. The weightage of food is significantly higher in CPI compared to WPI.

- The Shift: Earlier, the Reserve Bank of India (RBI) used WPI for policy decisions. Now, under the new framework, the RBI uses CPI (Combined) as the key measure of inflation to decide policy rates.

- Authority: Published by the National Statistical Office (NSO).

Base Year: For both WPI and CPI, the current base year (the reference year used for comparison) is 2011-12. However, the government is working on revising this to 2022-23 to reflect current economic realities.

Causes and Impact of Inflation in India: The Indian Rollercoaster #

The Causes of Inflation in India is often a mix of structural and monetary factors:

- Money Supply: An increase in money supply (printing more currency or easy loans) leads to more demand. If output doesn’t match this, prices rise.

- Imported Inflation: India imports nearly 80% of its energy needs. If the rupee depreciates (becomes weaker) against the dollar, importing oil becomes costlier, raising prices across the economy.

- Monsoon Dependence: A poor monsoon creates a shortage of food grains, leading to a spike in food inflation

The Impacts of Inflation are not inherently bad. A low and moderate level of inflation is actually good because it encourages investment and production. However, high inflation is dangerous:

- The Poor Suffer: It acts as a regressive tax. A price rise hurts the poor much more than the rich because a larger portion of their income goes into basic survival.

- Savings Erode: If you keep money in a bank at 5% interest but inflation is 6%, the real interest rate is negative. You are effectively losing purchasing power.

- Lenders Lose, Borrowers Gain: Inflation benefits debtors (borrowers) because they repay money that is worth less than when they borrowed it. Conversely, creditors (lenders) and bondholders lose.

- Exports Suffer: High domestic inflation makes Indian goods expensive and less competitive in the global market.

Deflation and Stagflation: The Scary Cousins #

While inflation is rising prices, you must also know its cousins.

Deflation

This is the opposite of inflation—a persistent fall in the general price level. While cheap goods sound great, deflation is dangerous. If prices fall, businesses stop producing, leading to unemployment. It is often caused by a collapse in demand.

Note

Disinflation is different from deflation. Disinflation is simply a slowing down of the rate of inflation (e.g., inflation dropping from 6% to 4%), but prices are still rising.

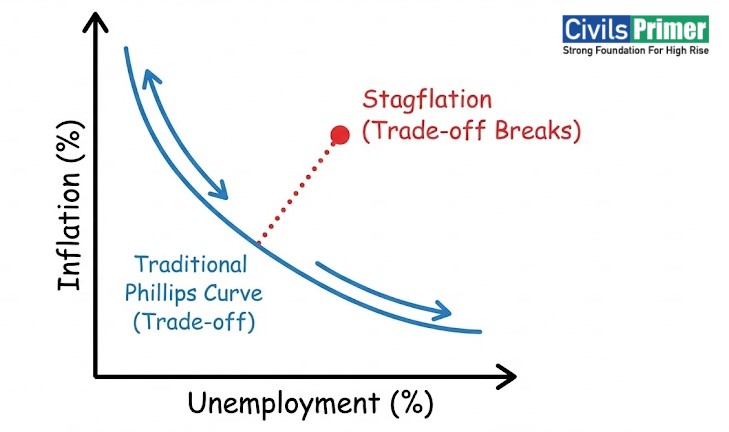

Stagflation: This is the worst-case scenario. Stagflation is a combination of Stagnant economic growth (high unemployment) and High Inflation.

- Usually, inflation rises when growth is high (Phillips Curve). Stagflation breaks this rule.

- It typically happens due to a supply shock, like the sudden rise in oil prices in the 1970s.

Inflation Control Measures: The Guardians #

How does India fight the inflation? The battle is fought on two fronts: Fiscal Policy (Government) and Monetary Policy (RBI).

- Fiscal Policy (The Government’s Tools)

- Taxation: To reduce demand, the government can increase direct taxes, taking money out of people’s pockets.

- Spending: The government can reduce its own wasteful expenditure to cool down aggregate demand.

- Supply Management: To fight cost-push inflation, the government can ban exports of essential items (like onions or wheat) or reduce import duties on them to increase domestic supply.

- Role of RBI in Inflation Management (Monetary Policy)

The Reserve Bank of India (RBI) is the primary guardian of price stability. Under the Inflation Targeting Framework, the RBI has a statutory mandate to keep CPI inflation at 4% with a tolerance band of +/- 2% (i.e., between 2% and 6%).

The Weapons of RBI: (Don’t worry, You will read them thoroughly later in Monetary Policy chapter also.)

- Repo Rate: This is the interest rate at which RBI lends money to commercial banks. To fight inflation, RBI increases the Repo Rate (Tight/Hawkish Policy). This makes loans expensive, reducing the money supply and demand in the economy.

- Cash Reserve Ratio (CRR): The percentage of deposits banks must keep with the RBI. Increasing CRR sucks liquidity out of the market, helping control inflation.

- Open Market Operations (OMO): The RBI sells government securities in the market to absorb excess money from the system.

- SDF (Standing Deposit Facility): A tool to absorb excess liquidity from banks without offering collateral, serving as a floor for interest rates.

Summary for Prelims #

- Inflation: Persistent rise in prices.

- WPI: Wholesale level, goods only, Ministry of Commerce.

- CPI: Retail level, goods + services, NSO, used by RBI for policy.

- Inflation Target: 4% (+/- 2%).

- Stagflation: High Inflation + High Unemployment.

- To Control Inflation: Increase Repo Rate, Increase CRR, Decrease Government Spending.

Inflation UPSC Mains PYQs #

Inflation, Deflation and Price Stability

- 2019: Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments.,

- 2015: Craze for gold in Indians has led to a surge in import of gold in recent years and put pressure on balance of payments and external value of rupee. In view of this, examine the merits of the Gold Monetization Scheme.

- 2013: What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2003? Discuss critically its salient features and their effectiveness. (Relevant to Inflation Control Measures via fiscal discipline)

Related Inflation Current Affairs #

Inflation, Deflation and Price Stability Current Affairs

| (October, 2025): GST Rate Rationalisation to Curb Inflation The GST Council approved a simplified two-tier tax structure (5% and 18%) to reduce the tax burden on essentials. This rationalisation is expected to lower CPI inflation by 10-15 basis points for food items and 5-10 basis points for services |

| (October, 2025): Challenges of Persistently Low Inflation With CPI inflation falling to 2.07% and WPI to 0.52% in August 2025, concerns were raised regarding “slower Nominal GDP growth” and weaker tax revenues. While beneficial for consumers, persistently low inflation risks straining the government’s Fiscal Deficit ratios |

| (October, 2025): Review of RBI’s Flexible Inflation Targeting (FIT) Framework As the current FIT framework expires in March 2026, the RBI released a discussion paper seeking views on retaining the 4% headline CPI target. Most stakeholders supported continuing the existing parameters (4% target with a 2-6% tolerance band) to anchor inflation expectations,,. |

| (September, 2025): OECD Projects Moderating Inflation for India The OECD Economic Outlook report upgraded India’s GDP forecast to 6.7% for 2025 while projecting a moderation in inflation to 2.9%. This highlights a trend of reduced inflationary pressures amidst global economic uncertainty |

| (July, 2025): India’s “Goldilocks Moment” with Low Inflation The Finance Ministry described the Indian economy as being in a “Goldilocks Moment”—characterized by robust growth accompanied by low inflation. Retail inflation dipped to a 75-month low of 2.82% in May 2025, aided by the RBI’s accommodative monetary policy |