The Financial Arteries of India #

Imagine the Government of India as a massive engine that powers the nation—building roads, defending borders, and feeding the poor. To keep this engine running, it needs fuel. That fuel is Tax.

In the Indian economy, this fuel comes through two distinct pipelines: Direct Taxes and Indirect Taxes. Over the last decade, India has undergone a massive renovation of these pipelines (Tax Reforms) to fix leaks (Tax Evasion) and ensure the fuel flows smoothly (Compliance). Let’s explore how this system works.

Direct vs. Indirect Taxes: The Two Pipelines #

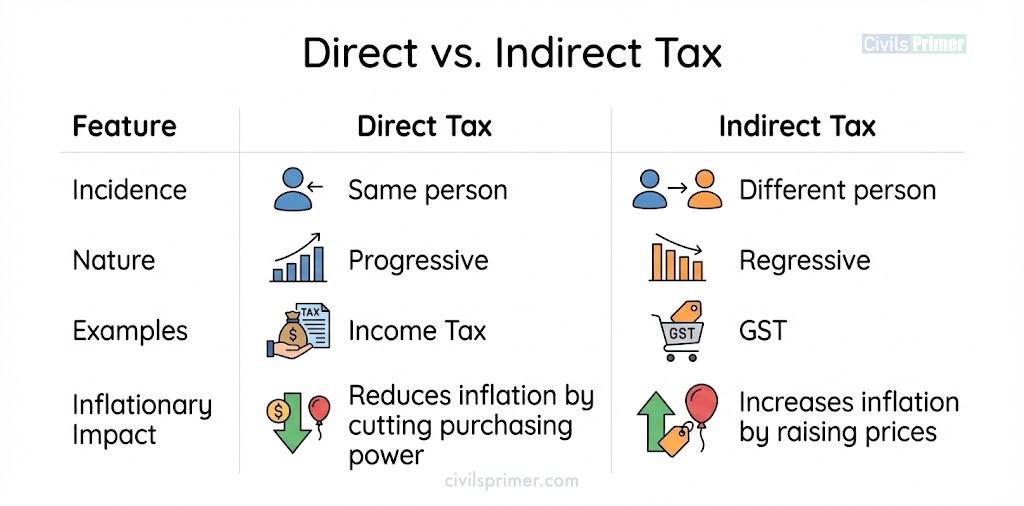

The fundamental difference lies in incidence (who is asked to pay) and impact (who actually loses the money).

A. Direct Tax (The Targeted Hit) : This is a tax levied directly on your income or wealth.

- The Logic: If you earn money, you pay a share to the government. The burden cannot be shifted to someone else.

- Nature: It is Progressive. The more you earn, the higher percentage you pay. This aims to reduce income inequality.

- Examples:

- Income Tax: Paid by individuals.

- Corporation Tax: Paid by companies on their profits.

- Securities Transaction Tax (STT): Paid on stock market trades.

B. Indirect Tax (The Hidden Cost) : This is a tax levied on consumption (goods and services).

- The Logic: You buy a soap or eat at a restaurant; the tax is included in the bill. The shopkeeper collects it and pays the government. The burden is shifted from the seller to you.

- Nature: It is Regressive. A billionaire and a daily wage earner pay the same tax on a packet of biscuits. It doesn’t care about your income level.

- Examples: Goods and Services Tax (GST), Customs Duty, Excise Duty on Petrol/Diesel.

Income Tax Structure in India: The Rulebook #

For a long time, India’s income tax structure was riddled with exemptions (loopholes) that made the system complex. To fix this, the government introduced a New Tax Regime (under Finance Act 2023) which has now become the default regime.

The Philosophy: “We will lower the tax rates, but you must give up the old exemptions (like HRA, LTA).” This simplifies the process and reduces paperwork.

Latest Slabs (FY 2024-25 / Assessment Year 2025-26): The government has made income up to ₹3 Lakh tax-free. Furthermore, with a rebate under Section 87A, individuals earning up to ₹7 Lakh effectively pay zero tax.

| Income Slab | Tax Rate |

| ₹0 – ₹3 Lakh | Nil |

| ₹3 Lakh – ₹7 Lakh | 5% (Rebate available) |

| ₹7 Lakh – ₹10 Lakh | 10% |

| ₹10 Lakh – ₹12 Lakh | 15% |

| ₹12 Lakh – ₹15 Lakh | 20% |

| Above ₹15 Lakh | 30% |

Corporate Tax: To attract investment, the tax rate for existing domestic companies was slashed to 22% (effective 25.17% with cess/surcharge), and for new manufacturing companies, it is as low as 15%.

Virtual Digital Assets (VDAs/Crypto): The new Income Tax Bill treats crypto like property. Profits are taxed as capital gains, and a 1% TDS is applied to track transactions, aligning with global standards.

Goods and Services Tax (GST): The Great Unifier #

Before 2017, India’s indirect tax system was a mess. States had different VAT rates, the Centre had Excise duty, and goods moving across borders faced Entry Tax/Octroi. It was a “Cascade of Taxes” (Tax on Tax).

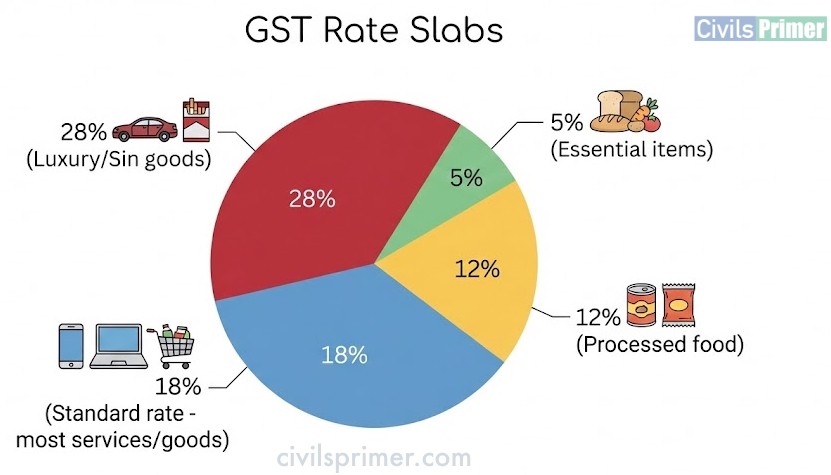

Entering GST (July 1, 2017): It subsumed 17 different taxes to create “One Nation, One Tax.” It is a destination-based consumption tax, meaning the tax money goes to the state where the good is consumed, not where it is manufactured.

The Structure:

- CGST (Central GST): Goes to the Centre.

- SGST (State GST): Goes to the State.

- IGST (Integrated GST): Levied on inter-state trade (collected by Centre, shared with State).

- GST Compensation Cess: A temporary levy on luxury/sin goods (like cars, tobacco) used to compensate states for revenue loss during the transition.

What is OUT of GST? Alcohol for human consumption, Petroleum products (Petrol, Diesel, ATF), and Electricity are still outside GST. States rely heavily on these for their own revenue.

GST Council: The Supreme Commander #

Who decides if the tax on a pencil should be 5% or 12%? It isn’t the Prime Minister alone. It is the GST Council, a constitutional body under Article 279A.

Composition:

- Chairperson: Union Finance Minister.

- Members: Ministers of State for Finance + Finance Ministers of all States.

- Voting Power: Centre has 1/3rd voting power; States have 2/3rd. Decisions require a 3/4th majority. This forces Cooperative Federalism—Centre and States must agree.

Recent Developments (55th GST Council Meeting):

- Hikes: GST on used Electric Vehicles (EVs) and small petrol/diesel cars raised to 18% to align with new vehicles. Luxury items like high-end watches also saw a hike.

- Relief: Full GST exemption on term life insurance premiums and health insurance for senior citizens. Rates lowered on essential items like cancer drugs and fortified rice kernels.

Tax Reforms: Fixing the Engine #

India has historically suffered from low tax collection. To fix this, the government launched massive reforms:

1. Digitalization & Faceless Assessment: Earlier, tax officials could harass taxpayers. Now, the Faceless Assessment scheme eliminates human interface. A computer randomly assigns tax returns to officers in different cities, reducing corruption.

2. Project Insight: The Income Tax department uses Big Data analytics to track high-value purchases (luxury cars, foreign travel) and match them with declared income to catch evaders.

3. Vivad se Vishwas: A scheme to reduce the massive backlog of tax litigation. It offers to settle disputes if the taxpayer pays the principal tax amount, waiving penalties and interest.

4. E-Way Bill: For GST, any good worth over ₹50,000 being transported requires an electronic way bill. This tracks movement and prevents goods from being sold “off the books”.

Tax Buoyancy and Compliance: The Health Check #

How do we know if these reforms are working? We look at two indicators.

Tax Buoyancy: This measures how much tax revenue increases when the GDP grows.

- Formula: % Change in Tax Revenue / % Change in GDP.

- Status: A buoyancy greater than 1 is excellent. Recently, direct Tax Buoyancy touched 2.52, the highest in 15 years, meaning tax collection is growing much faster than the economy.

Tax-to-GDP Ratio: This shows the size of the government’s tax kitty relative to the economy.

- Status: India’s ratio has historically been low (around 10-11%). However, projections for 2024-25 suggest it hitting a record 11.7%, driven by better compliance.

Compliance Trends:

- Net Direct Tax Collection surged to over ₹16.61 lakh crore in FY 2023-24.

- GST Monthly Collection has stabilised at a very high level, averaging over ₹1.51 lakh crore per month, indicating that the system has matured and compliance has improved.

Summary Checklist for Prelims #

- New Tax Regime: Default regime; rebate up to ₹7 Lakh (Section 87A).

- GST Council: Constitutional body (Art 279A); Centre (1/3 vote), States (2/3 vote); Decision (3/4 majority).

- Tax Buoyancy: Value > 1, indicates a healthy tax system (revenue growing faster than GDP).

- Trends: Direct Tax share is increasing (Progressive); Indirect Tax share is stabilizing.

- Exclusions: Alcohol and Petrol are not under GST yet.

By mastering these concepts of the Indian Taxation System UPSC Syllabus, you understand not just how the government earns, but how it shapes the economic behaviour of 1.4 billion people.

Mains PYQs: Tax System in India, Indian Taxation System #

Indian Taxation System Mains PYQs

- 2020: Explain the rationale behind the Goods and Services Tax (Compensation to states) act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions?

- 2019: Enumerate the indirect taxes which have been subsumed in the goods and services tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017.

- 2018: Comment on the important changes introduced in respect of the Long Term Capital Gains Tax (LTCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019.,

- 2017: One of the intended objectives of Union-Budget 2017-18 is to ‘transform, energize and clean India’. Analyze the measures proposed in the Budget 2017-18 to achieve the objective.

- 2015: There is a clear acknowledgement that Special Economic Zones (SEZs) are a tool of industrial development, manufacturing and exports. Recognising this potential, the whole instrumentality of SEZs requires augmentation. Discuss the issues plaguing the success of SEZs with respect to taxation, governing laws and administration.

- 2015: Discuss the rationale for introducing Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in rolling out for its implementation.

Current Affairs: Tax System in India, Indian Taxation System UPSC #

Indian Taxation System Current Affairs

| [October, 2025] -> GST Council Approves Next-Gen GST 2.0 Reform: The 56th GST Council meeting approved a simplified two-tier tax structure (5% and 18%) and a 40% de-merit rate for sin goods. This reform eliminates the 12% and 28% slabs to reduce classification disputes and exempts individual health/life insurance premiums from GST. |

| [October, 2025] -> Import Duty Exemption on Cotton Extended: The government extended the duty-free import policy for cotton until December 31, 2025, to lower input costs for the textile value chain. This move aims to mitigate the impact of 50% tariffs imposed by the US on Indian textile exports. |

| [September, 2025] -> Income Tax Act 2025 Receives Presidential Assent: The new Act replaces the Income Tax Act of 1961, reducing sections from 819 to 536 to simplify the direct tax regime. It formally introduces the concept of a ‘Tax Year’ (April 1 start) to replace ‘Assessment Year’ and streamlines provisions for digital transactions,. |

| [September, 2025] -> Rollout of GST 2.0 “GST Bachat Utsav”: The government launched GST 2.0 reforms focusing on rate rationalisation and simplified compliance. Key changes include reducing rates on over 375 items and automating refunds to boost consumption and investment, termed as the “GST Bachat Utsav”. |

| [August, 2025] -> Withdrawal of Digital Services Taxes (Equalisation Levy): The 2% Equalisation Levy on e-commerce supplies was removed in August 2024, and the 6% levy on online advertising services is withdrawn from April 2025 via the Finance Act, 2025. This aligns India with the OECD global tax framework. |

| [July, 2025] -> Debate on State Compensation for GST Reforms: With the end of the GST Compensation Cess in July 2025, states demanded a larger share of the divisible tax pool or a new stabilization fund. The Centre’s reliance on non-shareable cesses has shrunk the divisible pool from 88.6% to 78.9%, raising federal fiscal concerns. |

| [July, 2025] -> 8 Years of GST Implementation: Marking 8 years of GST, the government highlighted the growth of the taxpayer base to 1.45 crore and monthly collections averaging ₹1.65 lakh crore. Automation has significantly improved IGST refund processing for exporters, though compliance burdens for MSMEs remain a challenge. |

| [May, 2025] -> 16th Finance Commission and Fiscal Devolution: The 16th Finance Commission faces the challenge of addressing the shrinking divisible tax pool due to rising cesses and surcharges. States are demanding a cap on these non-shareable levies and an increase in the vertical devolution share beyond 41%,. |

| [February, 2025] -> Union Budget 2025-26 Tax Reforms: The budget increased the income tax exemption limit to ₹12 lakh under the new regime and raised the standard deduction to ₹75,000. It also introduced a presumptive taxation regime for non-residents in electronics manufacturing to reduce litigation. |

| [December, 2024] -> Withdrawal of Windfall Gains Tax: The government withdrew the windfall gains tax on domestic crude oil production and exports of diesel, petrol, and ATF. Initially introduced in 2022 to capture super-normal profits during global oil price surges, its removal aims to encourage private sector investment. |