Imagine the Government of India as a massive joint family. Just like any family, it earns money (income) and spends money (expenditure). It wants to build a bigger house (Infrastructure) while making sure everyone eats well (Subsidies). But often, the family spends more than it earns, leading to debt.

The set of rules the “Head of the Family” (Government) uses to manage this earning, spending, and borrowing is called Fiscal Policy. Unlike the RBI (Monetary Policy) which controls the supply of money, the Government controls the direction of money through the Budget.

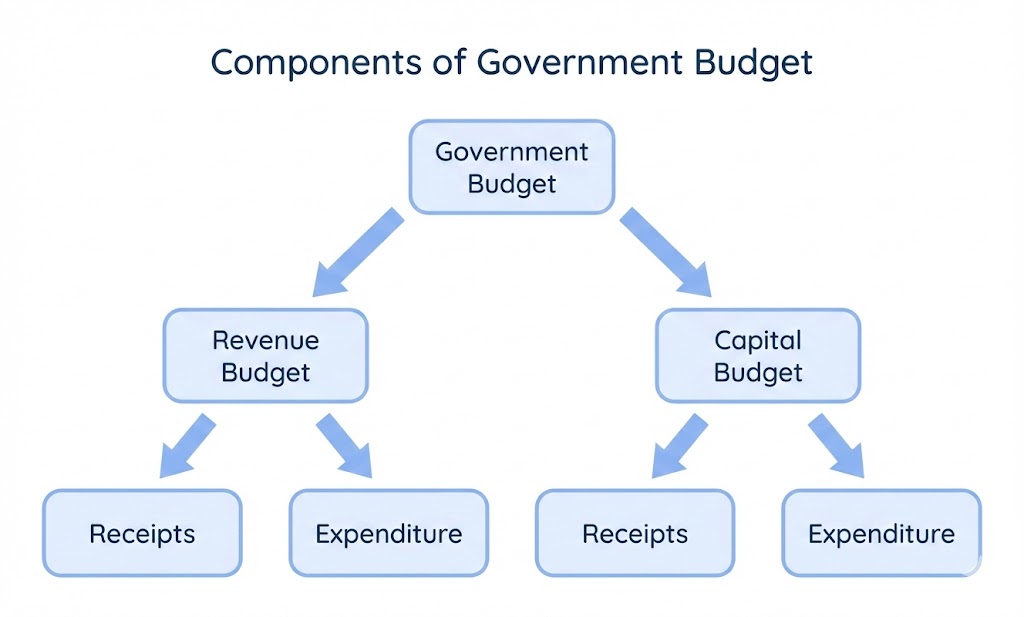

Revenue and Capital Accounts: The Two Pockets #

To keep things organized, the Government keeps two separate pockets in its wallet. This is the foundation of the Annual Financial Statement (Article 112), popularly known as the Budget.

Pocket 1: The Revenue Account (Daily Needs): Think of this as the “Housekeeping Pocket.”

- Revenue Receipts (Income): This is money that comes in and doesn’t have to be returned. It doesn’t create any debt or reduce any assets.

- Tax Revenue: Money from your Income Tax, GST, Corporate Tax.

- Non-Tax Revenue: Dividends from PSUs (like ONGC or LIC), interest on loans given to States, or fees for services,.

- Revenue Expenditure (Spending): This is spending on daily maintenance. It essentially “burns” money without building a factory or road.

◦ Examples: Salaries of government employees, pensions, interest payments on past loans, and subsidies,.

Pocket 2: The Capital Account (Assets & Liabilities) – Think of this as the “Investment & Loan Pocket.”

- Capital Receipts (Income): This is money that comes in but either creates a debt or reduces an asset.

- Debt-creating: Borrowing from the market (Government Bonds).

- Non-debt creating: Selling shares of a PSU (Disinvestment) or recovering a loan given to a State.

- Capital Expenditure (Spending): This is the good kind of spending! It creates physical assets or reduces financial liabilities. Examples: Building highways, airports, schools, or repaying old loans.

Types of Deficits: The Holes in the Pocket #

Usually, the Government spends more than it earns. This gap is called a Deficit. But not all deficits are the same. In the Indian Fiscal Policy UPSC syllabus, understanding the nuance is crucial.

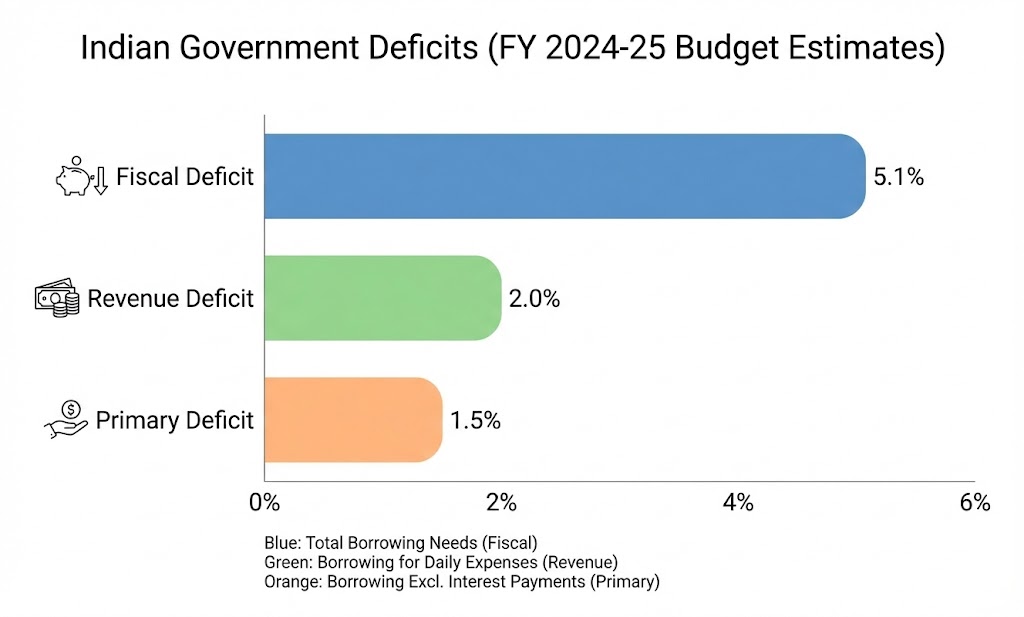

A. Fiscal Deficit (The Total Borrowing) This is the most famous number. It represents the total money the government needs to borrow to pay its bills.

- Formula: Total Expenditure – (Revenue Receipts + Non-debt Capital Receipts).

- Meaning: If the Fiscal Deficit is 5.9%, it means the government is borrowing an amount equivalent to 5.9% of the GDP to survive. It indicates the total borrowing requirement,.

B. Revenue Deficit (Living Beyond Means) This happens when the government spends more from its “Daily Needs Pocket” (Revenue) than it earns in that pocket.

- Formula: Revenue Expenditure – Revenue Receipts.

- Meaning: The government is borrowing money just to pay salaries or interest. It’s like taking a loan to buy groceries—a sign of poor financial health.

C. Effective Revenue Deficit (ERD) Sometimes, the Centre gives grants to States. Technically, this is “Revenue Expenditure” for the Centre. But if States use that money to build a bridge (Capital Asset), it shouldn’t be considered “wasteful.”

- Formula: Revenue Deficit – Grants for Creation of Capital Assets.

D. Primary Deficit (The Actual Overspending) The government pays a huge amount of interest on loans taken by previous governments. If we remove that past burden, how is the current government managing its finances?

- Formula: Fiscal Deficit – Interest Payments.

- Meaning: If Primary Deficit is zero, it means the government is borrowing only to pay interest on old loans.

FRBM Act, 2003: The Rule Book #

Governments love to spend to win votes (Populism). To prevent them from borrowing endlessly and bankrupting the nation, Parliament passed the Fiscal Responsibility and Budget Management (FRBM) Act, 2003.

The Goal: Fiscal Discipline –

- Targets: Originally, it aimed to reduce the Fiscal Deficit to 3% of GDP.

- N.K. Singh Committee (2016): Reviewed the act and recommended a “Glide Path.”

- Debt-to-GDP Ratio target: 60% (40% for Centre, 20% for States).

- Escape Clause: Allowed the government to breach targets by 0.5% during calamities, wars, or structural reforms (like when COVID-19 hit).

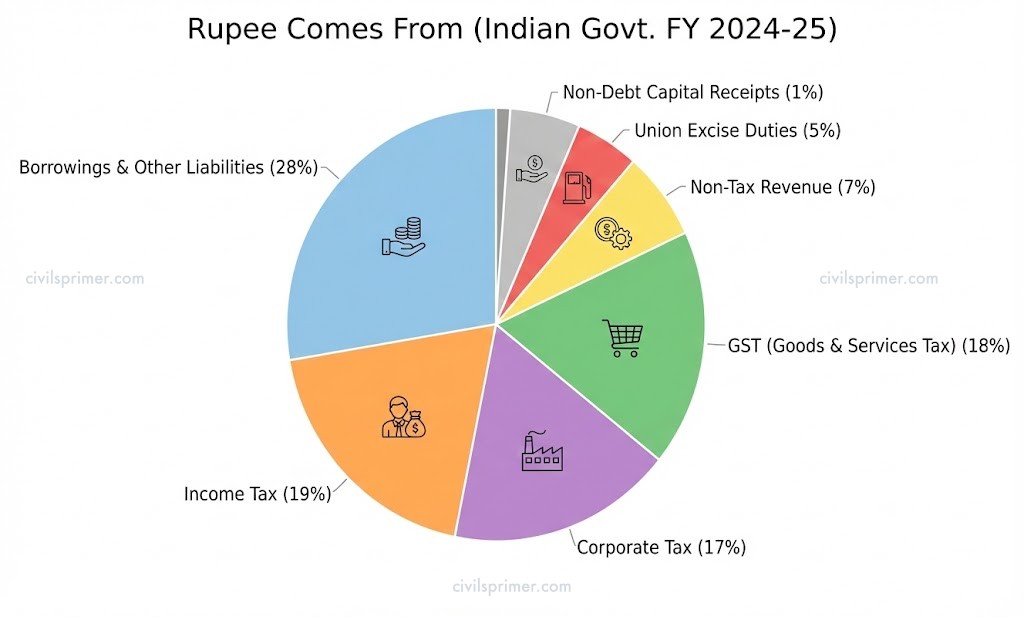

Tax and Non-Tax Revenue: The Sources of Cash #

How does the family earn?

Tax Revenue

- Direct Taxes: Paid directly by the person/company to the government.

- Examples: Income Tax, Corporate Tax, Capital Gains Tax.

- Trend: Direct tax collections have been increasing, showing better compliance,.

- Indirect Taxes: Collected by an intermediary (like a shopkeeper) from the consumer.

- Example: GST (Goods and Services Tax). It subsumed many old taxes like VAT, Excise, and Service Tax into a single “One Nation, One Tax” system,.

Non-Tax Revenue Money earned from sources other than taxes.

- Fiscal Services: Currency printing, coinage.

- General Services: Power distribution, irrigation fees.

- Interest & Dividends: Profits from PSUs (like Coal India) or RBI transferring its surplus to the government.

Subsidies and Consolidation: Where Does the Money Go? #

Subsidies – The government provides financial support to make essential goods affordable.

- Major Subsidies: Food (largest), Fertilizer, and Petroleum.

- Issue: While necessary for welfare, high subsidies increase the Revenue Deficit. The government is trying to “rationalize” them (e.g., using Aadhaar/DBT to target only the needy).

Fiscal Consolidation – This is the process of improving the government’s financial health.

- How? By reducing the Fiscal Deficit and Debt.

- Strategy: Improving tax collection (Tax-to-GDP ratio), reducing wasteful expenditure, and increasing revenue through Disinvestment.

Important Budget Terminologies #

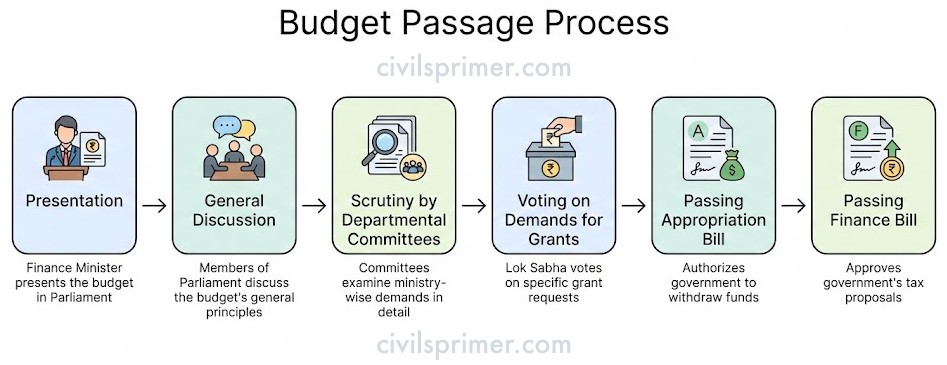

- Vote on Account: Since the Budget process takes time, Parliament passes a special provision to allow the government to withdraw money from the Consolidated Fund for a few months (usually 2 months) to keep the country running until the full Budget is passed.

- Guillotine: In Parliament, if there isn’t enough time to discuss the budget of every ministry, the Speaker puts all the remaining demands to vote at once without discussion. This is called the “Guillotine”.

- Outcome Budget: Introduced in 2005, it analyzes the progress and quality of the expenditure, not just the amount spent. It asks, “Did the money actually improve lives?”

Summary Checklist for Prelims #

- Revenue vs Capital: Salaries = Revenue Exp; Building Roads = Capital Exp.

- Fiscal Deficit: Indicates total borrowing requirement.

- Primary Deficit: Fiscal Deficit minus Interest Payments.

- FRBM Act: N.K. Singh Committee recommended Debt-to-GDP target of 60%.

- Article 112: Annual Financial Statement (The Constitutional name for Budget).

UPSC Mains PYQs: Fiscal Policy and Budgeting #

India Fiscal Policy – Mains PYQs

| Year | Question |

| 2021 | Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. |

| 2020 | Explain the rationale behind the Goods and Services Tax (Compensation to states) act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? |

| 2019 | The public expenditure management is a challenge to the Government of India in the context of budget making during the post liberalization period. Clarify it. |

| 2019 | Enumerate the indirect taxes which have been subsumed in the goods and services tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. |

| 2018 | Comment on the important changes introduced in respect of the Long Term Capital Gains Tax (LTCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019. |

| 2017 | One of the intended objectives of Union-Budget 2017-18 is to ‘transform, energize and clean India’. Analyze the measures proposed in the Budget 2017-18 to achieve the objective. |

| 2016 | Women empowerment in India needs gender budgeting. What are the requirements and status of gender budgeting in the Indian context? |

| 2015 | In what way could replacement of price subsidy with Direct Benefit Transfer (DBT) change the scenario of subsidies in India? Discuss. |

| 2015 | Discuss the rationale for introducing Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in rolling out for its implementation. |

| 2013 | What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2003? Discuss critically its salient features and their effectiveness. |

Latest Current Affairs New Briefs: Fiscal Policy and Budgeting UPSC Exam #

India Fiscal Policy and Budget

| [November, 2025] -> State Finances 2022-23 Audit Report Released: The CAG released a comprehensive report revealing that states’ total debt stood at 22.17% of GDP, breaching the FRBM target of 20%. All 28 states recorded fiscal deficits, highlighting significant gaps in revenue capacity and fiscal prudence. |

| [November, 2025] -> GST Council Approves Next-Gen GST 2.0 Reform: The 56th GST Council meeting approved a simplified two-tier tax structure (5% and 18%) and a 40% de-merit rate for sin goods. This reform eliminates the 12% and 28% slabs to reduce classification disputes and boost consumption,. |

| [October, 2025] -> End of GST Compensation Cess and State Fiscal Space: The abolition of the GST Compensation Cess in July 2025 triggered demands from states for a larger share of the divisible tax pool. States raised concerns over the Centre’s reliance on non-shareable cesses, which has shrunk the divisible pool from 88.6% to 78.9%,. |

| [October, 2025] -> Nutrient Based Subsidy (NBS) Rates for Rabi 2025-26: The Cabinet approved NBS rates for Phosphatic and Potassic fertilizers to ensure affordable availability to farmers. The scheme provides a fixed subsidy per kg of nutrient (N, P, K, S) to promote balanced soil nutrition,. |

| [September, 2025] -> Income Tax Act 2025 Receives Presidential Assent: The new Act replaces the Income Tax Act of 1961, reducing sections from 819 to 536 to simplify the direct tax regime. It formally introduces the concept of a ‘Tax Year’ and streamlines provisions for digital transactions and tax deductions,. |

| [July, 2025] -> Debate on Rationalising Food and Fertiliser Subsidies: With extreme poverty declining to 5.3%, policymakers discussed restructuring the ₹2.03 lakh crore food subsidy and ₹1.56 lakh crore fertiliser subsidy. Proposals include shifting to digital food coupons and deregulating fertiliser prices to improve fiscal efficiency,. |

| [June, 2025] -> 16th Finance Commission and Devolution Challenges: The 16th Finance Commission faces the task of addressing the vertical fiscal imbalance, as states demand an increase in the devolution share beyond 41%. The commission will examine the impact of cesses and surcharges on state revenues for the 2026-31 award period,. |

| [February, 2025] -> Fiscal Anchor Shift to Debt-to-GDP Ratio: The Union Government announced a strategic shift from using Fiscal Deficit to the Debt-to-GDP ratio as the primary fiscal anchor starting FY 2026-27. The target is to reduce the ratio to 50% by 2031 to ensure long-term sustainability. |

| [February, 2025] -> Union Budget 2025-26: Fiscal Deficit Targeted at 4.4%: The budget accelerated fiscal consolidation by reducing the Fiscal Deficit target to 4.4% of GDP from 4.8%. It also increased capital expenditure by 10% to ₹11.21 lakh crore and raised the income tax exemption limit under the new regime,. |

| [January, 2025] -> Launch of Fiscal Health Index (FHI) 2025: NITI Aayog released the FHI 2025 to evaluate the fiscal performance of 18 major states. The index tracks metrics like quality of expenditure, revenue mobilization, and debt sustainability to encourage fiscal prudence among states. |