Introduction: The Household Analogy #

Imagine India as a giant joint family. Just like your family earns money (salary) and spends money (groceries, rent), India earns foreign currency by selling goods (Exports) and spends it by buying things from other countries (Imports). This record of “Money Coming In” vs. “Money Going Out” is maintained in a massive book called the Balance of Payments (BoP). Unlike your family which uses Rupees, the world mostly deals in Dollars. Therefore, the External Sector is basically the story of how India manages its Dollars.

Balance of Payments (BoP): The Grand Record #

The Concept: The BoP is a systematic record of all economic transactions between the residents of India and the rest of the world over a specific period (usually a year). It acts like a weighing scale—it must always balance in accounting terms.

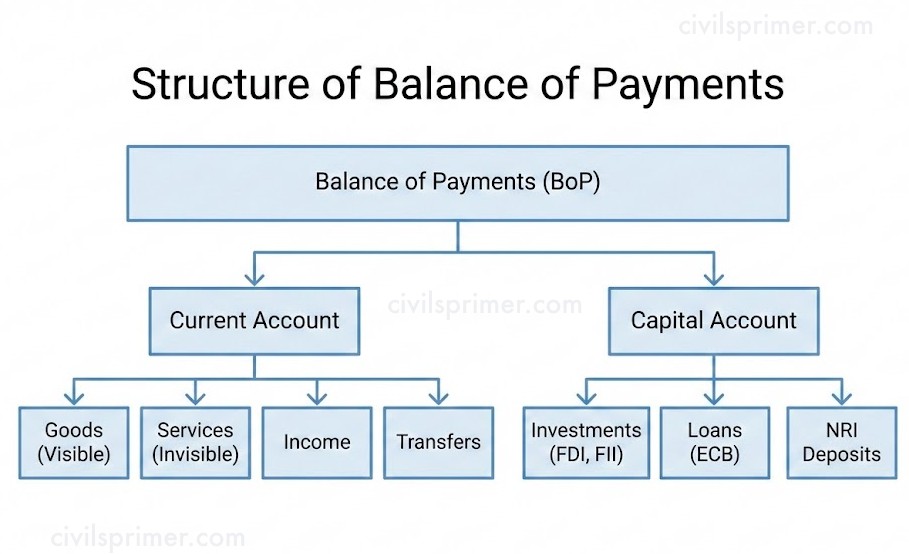

The BoP is divided into two main rooms (Accounts):

- Current Account: The “Daily Expenses” room.

- Capital Account: The “Assets and Investments” room.

Current and Capital Account: The Twin Pillars #

A. Current Account (The Day-to-Day) This account records transactions where the ownership of goods/services changes now. It has two parts:

- Visibles (Merchandise): Tangible goods like Crude Oil (Import) and Basmati Rice (Export). Since India imports more oil and gold than it exports software/textiles, we usually have a Trade Deficit.

- Invisibles: Things you can’t touch.

- Services: India is a champion here (IT, Medical tourism). We usually have a surplus here.

- Remittances: Money sent by Indians living abroad (e.g., in the Gulf or USA) to their families. India is often the top receiver of remittances in the world.

Current Account Deficit (CAD): When we spend more dollars on imports than we earn from exports, we have a CAD. India generally runs a CAD.

B. Capital Account (The Future Assets) This account records trading in assets. If a US company buys land in India or lends money to an Indian firm, it creates a future liability (we have to pay them back or give profits).

- Components: Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI), External Commercial Borrowings (ECB), and NRI Deposits.

The Golden Rule: We often use the surplus money from the Capital Account (foreigners investing in India) to pay for the deficit in the Current Account (our extra imports).

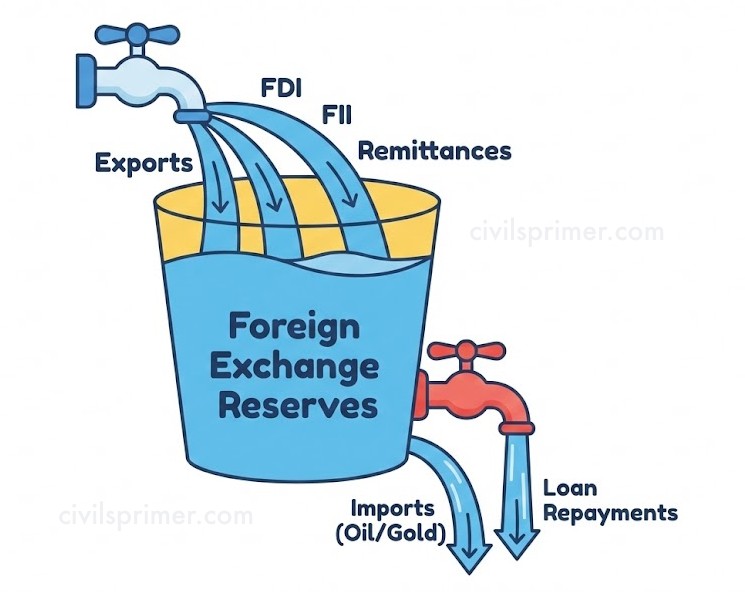

Foreign Exchange Reserves: The Safety Net #

What are they? These are assets held by the central bank (RBI) to back liabilities and influence the exchange rate. Think of it as India’s “Emergency Fund.”

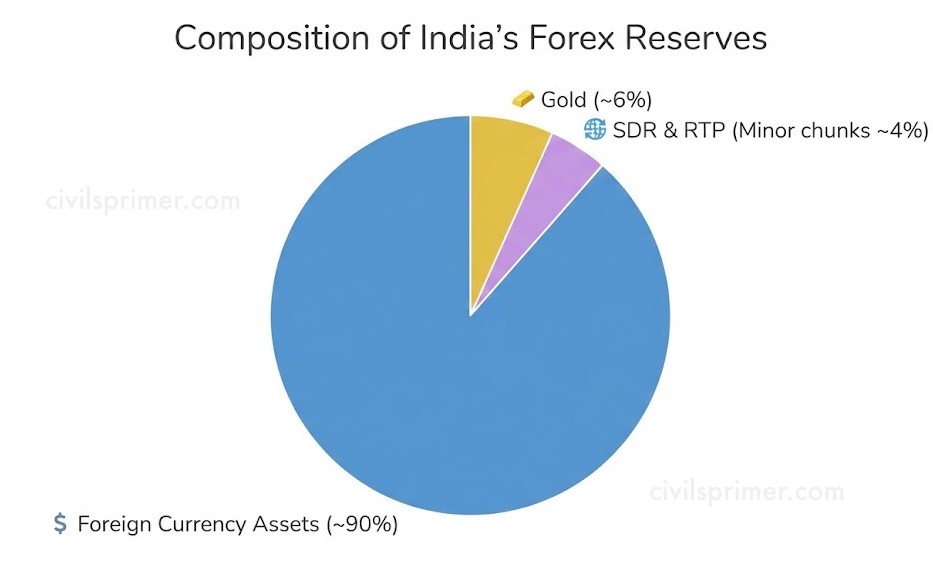

Composition of Forex Reserves:

1. Foreign Currency Assets (FCA): US Dollars, Euros, Pounds, Yen (Largest component).

2. Gold: Held by RBI.

3. SDRs (Special Drawing Rights): Often called “Paper Gold,” this is the currency of the IMF allocated to member countries.

4. Reserve Tranche Position (RTP): The quota of currency each member country provides to the IMF that can be utilised for its own purposes.

Significance: High reserves give confidence to global investors that India can pay its import bills even during a crisis (Import Cover).

Foreign Investment: FDI vs. FII/FPI #

Foreign money enters India in two major avatars. Let’s understand them using an analogy.

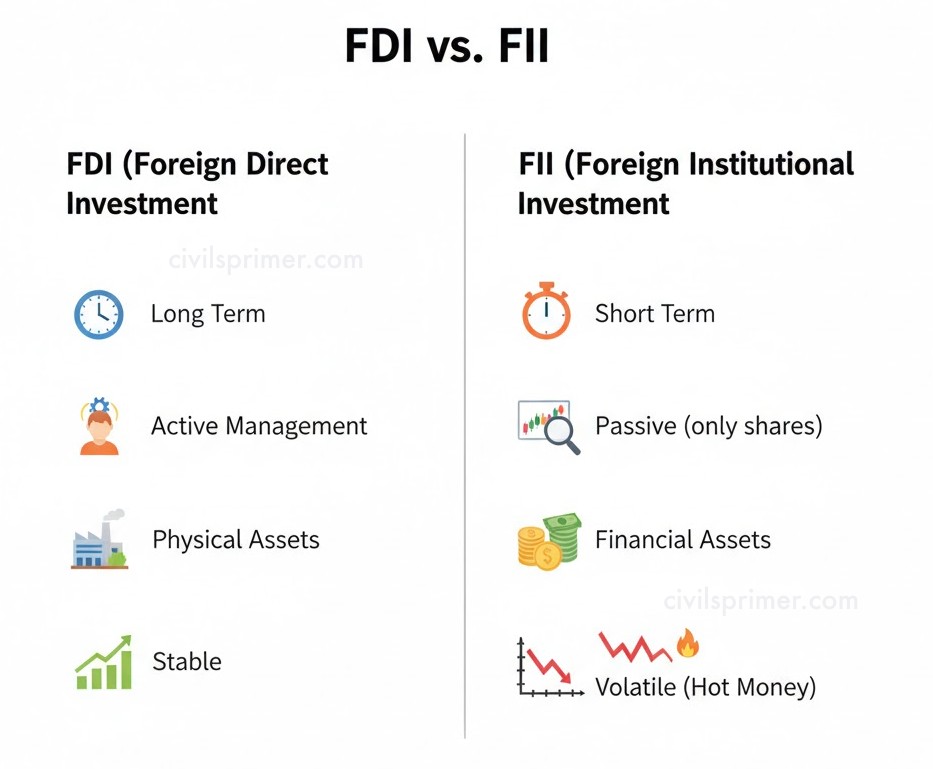

- Foreign Direct Investment (FDI) – “The Marriage”

- Concept: When a foreign company brings capital to set up a factory, buy a company, or build infrastructure in India for the long term.

- Nature: Stable. They bring technology, management skills, and create jobs. They can’t leave easily (you can’t pack up a factory in a suitcase).

- Routes: Automatic Route (No Govt approval needed) and Government Route (Approval needed for sensitive sectors).

- Foreign Institutional/Portfolio Investment (FII/FPI) – “The Tourist”

- Concept: When foreign investors buy shares or bonds of Indian companies in the stock market.

- Nature: Volatile. This is called “Hot Money”. If the US interest rates go up, these investors might sell their Indian shares and leave overnight, causing the stock market to crash.

Trade Deficit and Exchange Rate #

Trade Deficit: Occurs when Import Bill > Export Earnings.

- Main Culprits: Crude Oil (we import ~85%) and Gold.

- Impact: Puts pressure on the Rupee.

Exchange Rate: The Value of Rupee The price of the Dollar in terms of Rupees (e.g., $1 = ₹83) is determined by Demand and Supply.

- Depreciation: If Indians demand more dollars (to import oil or because FIIs are leaving), the Dollar becomes expensive, and Rupee becomes weak (e.g., moves from ₹80 to ₹85). This makes exports cheaper but imports costlier.

- Appreciation: If foreign dollars flood into India (FDI boom), the Rupee becomes strong.

- REER (Real Effective Exchange Rate): This is the weighted average of the Rupee against a basket of currencies, adjusted for inflation. It is a better measure of trade competitiveness than the simple nominal rate.

WTO Issues & Trade Agreements #

[ — Detailed Explanation in Later Chapters — ]

World Trade Organization (WTO): Established in 1995 to ensure rule-based free trade.

- India’s Stance: India fights for the rights of developing nations.

- Key Conflict: Food Subsidies. Developed nations argue India’s MSP (Minimum Support Price) distorts trade. India uses the “Peace Clause” to protect its right to buy food from farmers to ensure food security for the poor.

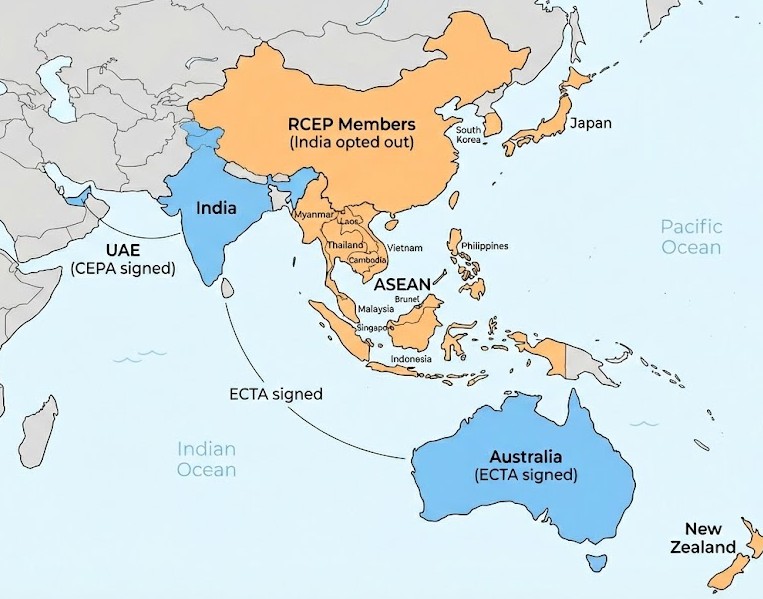

Trade Agreements:

- FTA (Free Trade Agreement): Two or more countries agree to reduce customs duties on goods.

- Recent Agreements: India signed the ECTA with Australia and CEPA with UAE to boost exports.

- RCEP (Regional Comprehensive Economic Partnership): A massive group of Asian nations. India opted out in 2019 to protect its dairy and manufacturing sectors from cheap Chinese and New Zealand imports.

Comparison: India vs. Developed Economies #

- Size: India is currently the 5th largest economy by nominal GDP and the 3rd largest by Purchasing Power Parity (PPP).

- Structure: Developed economies (US, UK) rely heavily on services and high-end manufacturing. India jumped directly from Agriculture to Services, skipping the massive industrialization phase that China went through.

- Trade Share: India’s share in global merchandise trade is less than 2%, while China is the “Factory of the World.” India aims to reach $2 Trillion exports by 2030.

In summary, The story of India’s external sector is one of transition. From a “closed” economy fearing foreign influence before 1991, India has transformed into a global player with record Forex Reserves and rising FDI. However, challenges remain: we buy more than we sell (Trade Deficit), our currency fluctuates with global winds (Volatile Exchange Rate), and we must navigate complex global trade wars (WTO/FTAs).

Mains PYQs #

UPSC Mains PYQ on External Sector and International Trade of Indian Economy

Balance of Payments (BoP) of India

- 2015→ Craze for gold in India has led to a surge in import of gold in recent years and put pressure on balance of payments and external value of the rupee. In view of this, examine the merits of the Gold Monetization Scheme. (12.5 M)

Foreign Direct Investment (FDI) in India

- 2021→ Foreign Direct Investment (FDI) in the defence sector is now set to be liberalized. What influence is this expected to have on Indian defence and economy in the short and long run? (12.5 M)

- 2016→ Justify the need for FDI for the development of the Indian economy. Why is there a gap between MOUs signed and actual FDIs? Suggest remedial steps to be taken for increasing actual FDIs in India. (12.5 M)

- 2015→ Discuss the impact of FDI entry into the multi-trade retail sector on supply chain management in the commodity trade pattern of the economy. (5 M)

- 2013→ Though India allowed Foreign Direct Investment (FDI) in what is called multi-brand retail through the joint venture route in September 2012, the FDI, even after a year, has not picked up. Discuss the reasons. (5 M)

Trade Deficit and Exchange Rate

- 2023→ What are the direct and indirect subsidies provided to the farm sector in India? Discuss the issues raised by the World Trade Organization (WTO) in relation to agricultural subsidies. (10 M)

WTO and Trade Agreements of India

- 2013→ The Food Security Bill is expected to eliminate hunger and malnutrition in India. Critically discuss various apprehensions in its effective implementation along with the concerns it has generated in WTO. (10 M)

Answer Writing Minors #

Option 1: The “Resilience & Transformation” Approach – Use this for questions regarding history (1991 reforms), Balance of Payments (BoP), Forex Reserves, or general health of the external sector.

- Introduction: “India’s external sector has undergone a paradigm shift from the closed, import-substitution era of the 1950s to a globally integrated economy post-1991 LPG reforms,. Today, with robust Foreign Exchange Reserves, the sector acts as a strong buffer against global headwinds, transitioning India from a ‘begging bowl’ situation in 1991 to a key player in the global economy.”

- Conclusion: “While ample forex reserves provide a cushion against external shocks, long-term stability requires reducing the Current Account Deficit (CAD) by diversifying exports beyond services and reducing oil dependency through renewable energy. Promoting the Internationalisation of the Rupee and integrating into Global Value Chains (GVCs) will be pivotal in insulating the Indian economy from global volatility and achieving the vision of ‘Atmanirbhar Bharat’.”

Option 2: The “Growth & Aspiration” Approach – Use this for questions regarding Export promotion, Trade Deficits, WTO issues, Free Trade Agreements (FTAs), or the $5 Trillion goal.

- Introduction: “The external sector is the linchpin of India’s aspiration to become a $5 Trillion economy, with a targeted goal of achieving 2trillioninexportsby2027,.Movingtowardsan∗∗export−ledgrowthstrategy∗∗,Indiahasachievedall−timehighmerchandiseexports(US 422 billion in FY’22), yet structural challenges like the high Trade Deficit and protectionist global trends necessitate a calibrated policy response involving both domestic reforms (PLI Scheme) and strategic engagement at the WTO,.”

- Conclusion: “To remain competitive amidst a slowing global economy, India must move beyond the ‘comparative advantage’ of cheap labour to ‘competitive advantage’ based on innovation and quality. Resolving inverted duty structures, rationalising tariffs, and finalizing balanced Free Trade Agreements (FTAs) with nations like the UK and EU are essential to transforming India into a global manufacturing hub while safeguarding the interests of its domestic MSMEs and agriculture sector,,.”

Latest Current Affairs #

External Sector and International Trade of India Current Affairs

| (November, 2025): IMF to Reclassify India’s Exchange Rate Regime The IMF announced plans to reclassify India’s exchange rate regime from “floating” to a “crawling peg” in its upcoming Article IV report. This change reflects the IMF’s view that the RBI actively intervenes to smooth rupee volatility, although India officially maintains a market-determined exchange rate. |

| (November, 2025): Export Promotion Mission (EPM) Approved To tackle the widening trade deficit and global tariff pressures, the Cabinet approved the EPM with an outlay of ₹25,060 crore. It targets sectors like textiles and engineering, aiming to enhance trade finance, market access, and logistics for Indian exporters. |

| (October, 2025): China Files WTO Complaint Against India over EV Subsidies China initiated a dispute settlement at the WTO, alleging that India’s subsidies for Electric Vehicles (PLI schemes and tax rebates) violate global trade rules by discriminating against foreign producers. This marks a significant escalation in trade tensions affecting India’s industrial policy. |

| (October, 2025): Forex Reserves Cross Historic $700 Billion Mark India’s foreign exchange reserves surged to a record high of over $702 billion. The increase was primarily driven by the RBI’s strategic gold purchases and valuation gains, strengthening India’s buffer against external sector shocks and currency volatility. |

| (October, 2025): Foreign Currency Settlement System (FCSS) Launched at GIFT City A real-time settlement system for foreign currency transactions (initially USD) was launched at GIFT IFSC. This reduces transaction costs and time for cross-border payments, easing capital account operations for Indian entities and reducing reliance on offshore intermediaries. |

| (October, 2025): India and Israel Sign Bilateral Investment Agreement (BIA) India signed a BIA with Israel, the first with an OECD nation under India’s new model text. The agreement provides legal certainty and dispute resolution mechanisms to boost Foreign Direct Investment (FDI) and paves the way for a future Free Trade Agreement. |

| (September, 2025): US Imposes 50% Tariffs on Indian Exports The US imposed reciprocal and secondary tariffs of up to 50% on Indian goods, affecting 55% of India’s exports to the US. This protectionist move threatens India’s trade surplus with the US and creates inflationary pressure on the rupee due to potential retaliatory costs. |

| (August, 2025): RBI Report Highlights ‘FDI Paradox’ The RBI Annual Report revealed that while gross FDI inflows rose, net FDI collapsed to just $0.4 billion in 2024-25 due to a surge in repatriation and disinvestments. This “paradox” signals structural issues in retaining long-term foreign capital despite high economic growth. |

| (August, 2025): India–UK Comprehensive Economic and Trade Agreement (CETA) Signed India and the UK signed a landmark FTA aiming to double bilateral trade to $112 billion by 2030. The pact eliminates tariffs on 99% of Indian goods, boosting sectors like textiles and leather, and facilitates service sector mobility, directly impacting the current account. |

| (July, 2025): Review of India-ASEAN Trade in Goods Agreement (AITIGA) India initiated a review of its FTA with ASEAN to address a ballooning trade deficit ($45.2 billion). The review focuses on preventing the circumvention of “rules of origin” and addressing non-tariff barriers to protect domestic industries from dumping. |